- by Amanda Gray

- September 23rd, 2021

- primeunicornindex.com

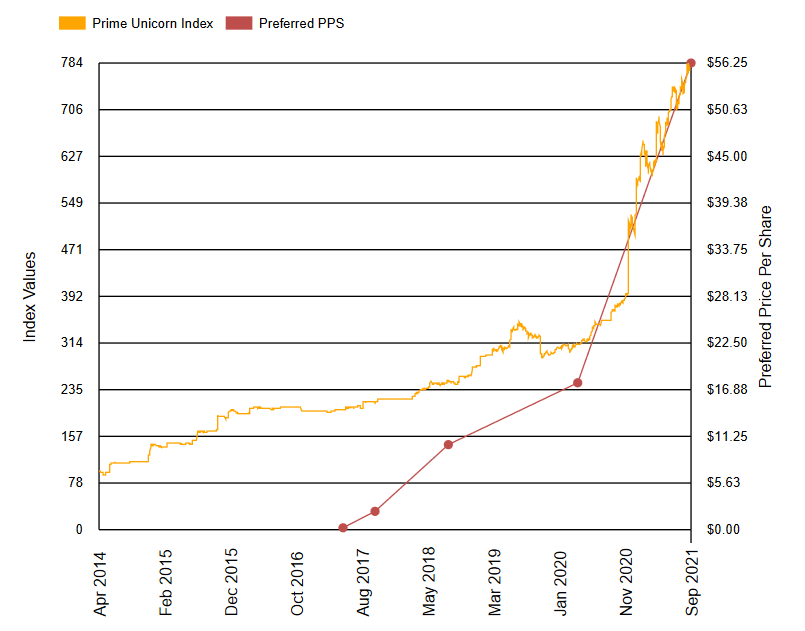

Devoted Health has just authorized a new Series D preferred stock which could increase the valuation to $13 billion if all Series D shares are issued. The healthcare insurance company is previously backed by Andreessen Horowitz, Premji Invest, Uprising Capital, Obvious Ventures, Venrock, F-Prime Capital, and Maverick Capital to name a few. The most recent Series D round follows $217 million raised for Series C. The terms surrounding the Series D include Senior liquidation preference to all other preferred, and conventional convertible meaning they will not participate with common stock if there are remaining proceeds. The most recent price per share is $56.2503, an up round from Series C at $17.7104.

The Prime Unicorn Index provides a unique opportunity for institutional investors to access a fair representation of the private markets where they can make an investment on the future of their portfolios, whether they want to go long or short.

Additionally, the Index provides up-to-date empirical data used to track today’s private capital markets and offer ways to offset exposure in regard to direct private market investments by taking advantage of the trading opportunities presented by Prime Unicorn Index.

Please contact us for information on trading opportunities with the Index.

Follow Prime Unicorn Index on Twitter and LinkedIn and be the first to know about early funding rounds and changes in valuations of these fast growing companies listed on the Index.

Bloomberg Ticker: PUNICORN

Reuters Ticker: .PUNICORN